Welcome to Rev Invest

A simple, accessible and affordable direct investment platform to help you kickstart your investment journey and reach your financial goals sooner.

What could your next $5000 become?

See how easy it is to get started

Whether you want to travel, buy a house, your dream car or just enjoy the satisfaction of building wealth, get ahead faster with Rev Invest.

Investment made easy

-

Register for access to the investor portal

Explore our portfolios, see past performance, access the fee calculator and latest news.

-

Select the right portfolio for your goals

Choose from one of five portfolios designed for different investment goals and horizons.

-

Open your account quickly and easily

Use our online application form with no paperwork required and start investing today.

-

Monitor your investment performance

Stay fully informed on portfolio performance and what's driving our investment decisions.

Meet our investment experts

Jeremy is responsible for the management of the REV Invest portfolios, working closely with FMD Group’s Investment Committee and appointed consultants.

Jeremy joined FMD in 2015 after heading investment research for Crowe Horwath, a national dealer group. Jeremy holds a Bachelor of Economics (Flinders) and a Graduate Diploma in Applied Finance and Investments from FINSIA.

Jeremy McPhail - Model Portfolio Manager, REV Invest

Richard is Chair of the FMD Investment Committee. Richard has worked with FMD Financial, parent company of REV Invest, since 2004. As Chair of the FMD Investment Committee, Richard works with the Committee to oversee the implementation and monitoring of portfolios and works closely with external consultants appointed by the Investment Committee. Richard is a Certified Investment Management Analyst (CIMA).

Richard Dahl - Investment Committee Chair, Adviser FMD FinancialOur portfolios are designed for different investment goals

| Portfolio Construction | Portfolio Performance | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Designed For | Perfect For | Stay Invested For | 1 Month | 3 Months | 6 Months | 1 Year | Since Inception (Annualised*) | ||||

| Springboard | Portfolio Construction | Saving for a major life milestone | Saving a home loan deposit | 2-3 Years | Portfolio Performance | 0.36% | 0.65% | 1.18% | 2.46% | 3.08% | |

| Balanced | Portfolio Construction | A balanced level of risk and reward | Wealth building | 5+ Years | Portfolio Performance | 0.04% | 0.33% | 4.93% | 10.06% | 10.75% | |

| Pure Growth | Portfolio Construction | More reward with a little more risk | Wealth acceleration | 7+ Years | Portfolio Performance | 0.14% | 0.57% | 6.38% | 12.14% | 13.06% | |

| Good Citizen | Portfolio Construction | Good returns that make the world a better place | Feel-good wealth creation | 5+ Years | Portfolio Performance | 0.00% | 0.51% | 4.51% | 9.56% | 11.06% | |

| Global Leaders | Portfolio Construction | Investing in big ideas with higher risk | Long-term innovative capital growth | 7+ Years | Portfolio Performance | 0.02% | 4.11% | 12.75% | 16.68% | 19.26% | |

|

|||||||||||

Our portfolios

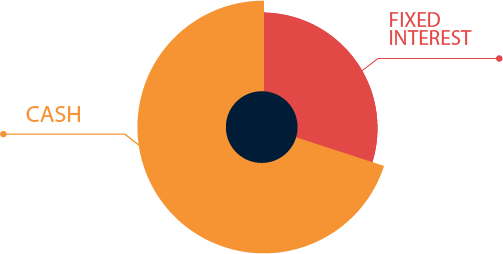

The Springboard portfolio is for those who want to save for a major life milestone with a minimum investment horizon of 2-3 years. Whether that’s a holiday of a lifetime, a dream car or perhaps a house deposit, Springboard could be for you.

The portfolio is constructed with a blend of exchange traded funds (ETFs) and managed funds, that invest into short-term cash and fixed interest assets. The portfolio is expected to have very low capital volatility and generate income across all stages of the interest rate cycle; aiming for better returns than bank term deposits. The portfolio has been constructed with a carefully selected blend of assets to ensure portfolio and return diversification. No growth assets will be held with the portfolio suitable for investors with a low risk tolerance. Note: unlike term deposits, there is a chance of negative returns.

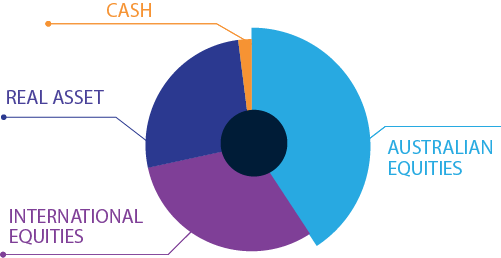

The Balanced portfolio has been created for investors who want a professionally managed portfolio that has growth potential and a focus on downside protection, who have an investment horizon of 5 years or more. Whether you are starting out on your investment journey or are building a long-term investment portfolio, Rev Invest’s Balanced portfolio could meet your objectives.

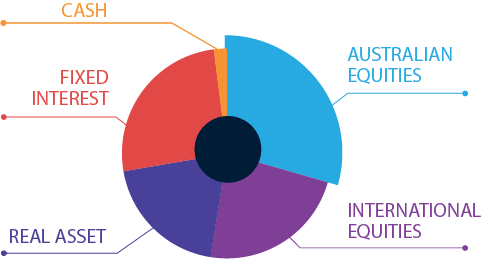

The portfolio is constructed with a blend of exchange traded funds (ETFs), to keep costs low. The portfolio aims to generate a mix of income and capital growth returns over the longer-term through exposure to cash, bonds and credit assets mixed with a blend of domestic and international shares as well as real assets (property and infrastructure).

Importantly, this blend (asset allocation) is not set and forget and will be adjusted tactically in response to market conditions to maximise potential income generation. This portfolio is suited to investors with a high risk tolerance and who are prepared to accept a high degree of volatility.

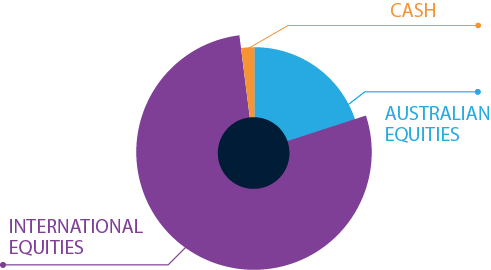

The Pure Growth portfolio is suited to investors who are prepared and willing to ride the ups and downs of the market to achieve greater returns and build a long-term investment portfolio. It is not suitable for investors with an investment horizon of less than 7 years.

The Pure Growth portfolio will be constructed with a blend of exchange traded funds (ETFs), with a focus on returns from capital growth over the longer-term. The portfolio will largely be exposed to a blend of domestic and international shares as well as real assets (property and infrastructure). This portfolio blend (asset allocation) is not set and forget and will be adjusted tactically in response to market conditions to maximise returns across the cycle.

The portfolio is suitable for investors with a very high risk tolerance and who are prepared to accept higher levels of volatility.

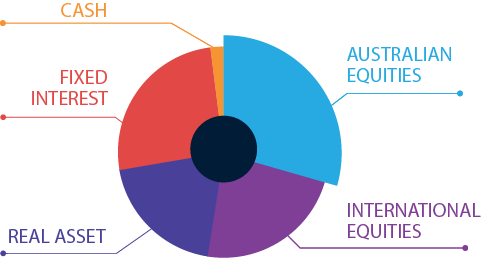

You don’t need to compromise your values to be a successful investor. The Good Citizen portfolio may suit investors who want to invest ethically for their future over periods of 5 years or more.

The portfolio is constructed with a blend of exchange traded funds (ETFs), that go through two screens before they are selected. Firstly, a negative screen to remove the bad: for example: tobacco, weapon manufacturers and companies with poor environmental, social or governance history. We then apply a positive screen to select quality investments that make a difference where possible. This might include ETFs that hold “Green bonds” which support ‘socially responsible’ investments such as social housing. This result is a diversified portfolio that invests into cash, bonds and credit assets along with a blend of domestic and international shares and real assets (property and infrastructure). This portfolio blend (asset allocation) is not set and forget and will be adjusted tactically in response to market conditions to maximise returns across the cycle.

The portfolio is suitable for investors with a high risk tolerance and who are prepared to accept a high level of volatility.

Want to access the biggest companies and ideas that have the potential to change the world? Then the Global and Future Leaders portfolio might be suitable for you. Given the high equity exposure, it is not suitable for investors with an investment horizon of less than 7 years.

The portfolio is constructed with a concentrated blend of exchange traded funds (ETFs), selected with a focus on the largest capitalisation shares domestically and internationally. In addition, we add smaller diversified tilts to emerging trends and thematic ETFs that are changing the world. This could include crypto infrastructure, battery technology or healthcare funds.

As chosen thematics run their course, they will be replaced by other emerging ideas. This portfolio is suitable for investors with a very high risk tolerance and who are prepared to accept higher levels of volatility.